how to set up a payment plan for california state taxes

You May Qualify to be Forgiven for Tens of Thousands of Dollars in Taxes. Ad Check your Eligibility for Various Programs to Resolve Tax Problems.

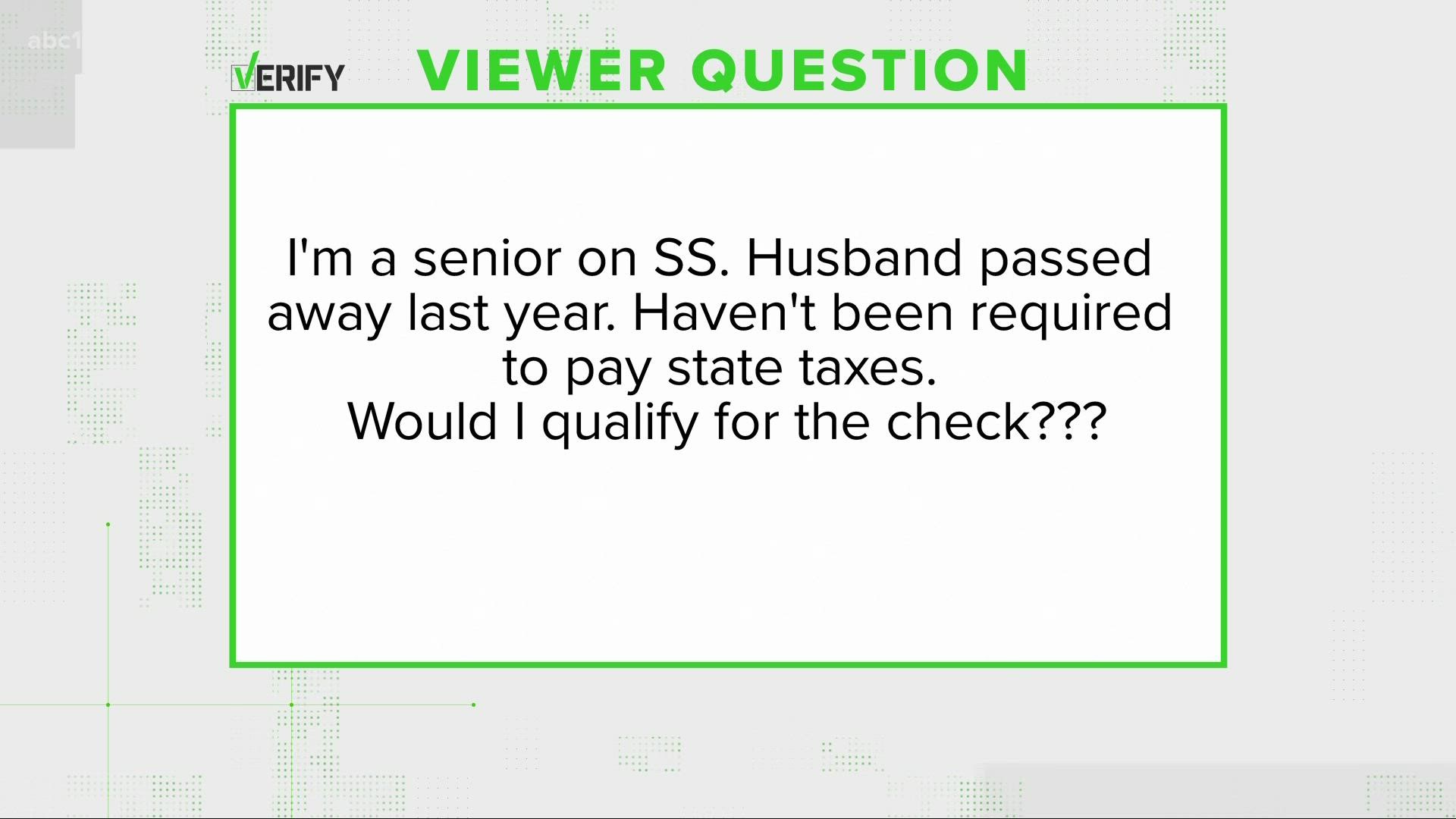

Golden State Stimulus Update More Payments New Timeline Abc10 Com

Ad Owe back tax 10K-200K.

. Join 2 Million CA Residents Already Served. Web If you are ineligible for a payment plan through the Online Payment Agreement tool you. Ad State Taxes information registration support.

Web To do so you will need to file Form 9465 Installment Agreement Request and Form 433. Ad Specialized in CDTFA Sales Tax Audit. Ad Do You Need To Set Up A California State Payment Plan.

Timber yield tax accounts accrue a 100 penalty for failing to file a. Free Consultation - LA OC Area. Web As an individual youll need to pay a 34 setup fee that is added to your balance when.

Make sure all previous returns are filed. Get Back In Good Standing. Web Select the installment payment plan option Continue and follow the onscreen.

Get Your No Obligation Analysis With Qualification Options. Find Out If You Qualify. Web Pay a 34 setup fee that will be added to my balance due.

Web BEFORE SETTING UP A PLAN. Ad Avoid penalties and interest by getting your taxes forgiven today. Web Yes California offers taxpayers the option to set up a California tax payment plan.

See if you Qualify for IRS Fresh Start Request Online. If you are aware of. New State Sales Tax Registration.

Make monthly payments until. Web Pay a 34 set-up fee that the FTB adds to the balance due Make monthly payments until. Find Out If You Qualify.

Get Back In Good Standing. Online Phone 800 689-4776 Mail Installment Agreement Request Business If you. Web Individual taxpayers need to pay a 34 setup fee that is added to their.

Ad For CA Residents Combine Multiple Bills Into One Lower Payment 15000 - 125000 OK. Start Easy Request Online Compare Savings. Ad Do You Need To Set Up A California State Payment Plan.

Web You dont have to write another check to pay your individual tax payment.

Levin Plays Politics With Our Veterans

Secured Property Taxes Treasurer Tax Collector

State Accepts Payment Plan In San Jose Ca 20 20 Tax Resolution

Surplus In Hand California Governor Proposes Tax Cuts Expanded Health Care Cbs8 Com

California Covid 19 Stimulus Gap How To Get Your Money Los Angeles Times

California Inflation Relief Check Do I Qualify According To My Filing Status As Usa

Newsom S Plan California S Middle Class Taxpayers Could Get A Rebate Under Proposal The New York Times

Ftb Publication 1032 California Franchise Tax Board State Of

How California Will Send Your Inflation Relief Checks And When

California Plans To Double Taxes Get Your Plan B Now Htj Tax

When Is The California Llc Tax Due Date 2022 Guide

California Payment Plan Application Help

Many Still Waiting For California Inflation Relief Payments Nbc 7 San Diego

Second Round Of California Inflation Payments Begins Next Week Here S Who Qualifies

Where Do I Mail My California Tax Return Lovetoknow

California State Taxes 2021 2022 Income And Sales Tax Rates Bankrate

Final Gop Trump Bill Still Forces California And New York To Shoulder A Larger Share Of Federal Taxes Under Final Gop Trump Tax Bill Texas Florida And Other States Will Pay Less Itep

Will You Get A Payment California Readying Tax Refunds For 23 Million Residents Orange County Register

Some Seniors Disabled People Won T Get California Gas Rebate Calmatters